Four Blockchain Use Cases Transforming Industries

In this article, we’ll dive into four really promising blockchain use cases. These aren’t just buzzwords – they’re actually changing industries and winning over the mainstream.

Amidst a world dominated by centralization and corporate control, the emergence of Decentralized Physical Infrastructure Networks (DePIN) presents a revolutionary approach. Leveraging blockchain technology and peer-to-peer protocols, this concept seeks to transform the construction and maintenance of physical networks.

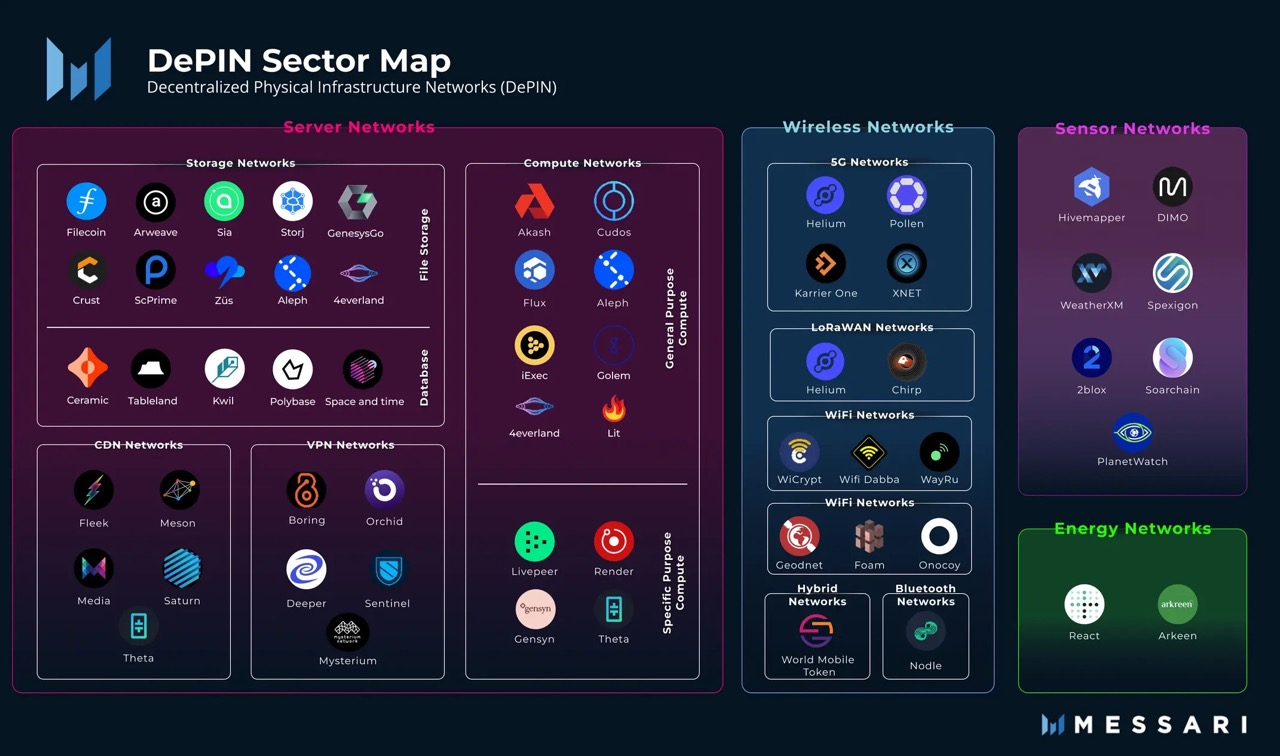

DePIN encompasses four primary categories, each addressing specific requirements:

Cloud/Storage Networks: Encompassing services like file storage, databases, content delivery networks (CDNs), and virtual private network (VPN) systems.

Wireless Networks: Enabling technologies such as 5G and Long Range Wide Area Network (LoRaWAN) to facilitate seamless Internet of Things (IoT) functionality.

Sensor Networks: Facilitating real-time data collection from interconnected devices, with applications ranging from mapping technologies to environmental monitoring.

Energy Networks: Aggregating distributed energy sources to establish a more resilient and efficient energy grid.

Potential: To start, DePIN introduces an innovative approach by incentivizing a community of volunteers through crypto tokens. This strategy propels infrastructure development at an astonishing pace, clocking in at 10-100 times faster than traditional methods. This unprecedented acceleration translates into unparalleled progress.

Next, DePIN’s decentralized nature grants it a distinctive advantage in hyper-local market alignment. This means it can finely tune its efforts to address specific demands within communities. This adaptability makes DePIN networks highly responsive and efficient, serving the unique needs of communities.

In terms of affordability, DePIN shines. It alleviates the financial strains typically linked to infrastructure projects. By delivering more streamlined and budget-conscious solutions, DePIN sets the stage for boundless growth opportunities.

Expanding on this, DePIN’s scalability across various jurisdictions in a permissionless manner stands as a key factor in its potential widespread adoption. By removing unnecessary barriers and complexities, DePIN easily transcends borders, setting the stage for a global impact.

A standout feature of Decentralized Physical Infrastructure Networks (DePIN) revolves around the notion of credibly neutral and collectively owned networks. These networks foster trust and community involvement, resulting in transparent and democratic approaches to constructing and sustaining essential infrastructure.

Lastly, DePIN’s integration with decentralized finance (DeFi) applications introduces seamless transactions and frictionless micropayments. This integration enhances accessibility and user-friendliness, adding an extra layer of appeal to its offering.

Obstacles: Challenges include potential delays in application deployment and demand generation, especially when compared to consumer-oriented projects. Established web2 giants may also present disruption challenges. Nonetheless, as awareness grows, DePIN’s influence and adoption are likely to expand.

The concept of tokenizing real-world assets holds substantial promise, effectively transforming tangible assets such as real estate, art, and collectibles into digital tokens recorded on a blockchain. This democratizes wealth creation, broadening investment opportunities and enhancing liquidity in traditionally illiquid markets.

Potential:

The potential for real-world asset tokenization to revolutionize various aspects of the world is quite compelling.

Firstly, it democratizes the creation of wealth and investment opportunities by enabling fractional ownership. This opens up traditionally illiquid markets to smaller investors. Notably, real estate is poised to benefit greatly from tokenization, offering fresh yield prospects in DeFi markets and improving liquidity and price discovery. Additionally, tokenization redefines industries like art and collectibles, breaking ownership into multiple shares. This democratizes the art market and addresses concerns like forgery and fraud.

Tokenization also extends to intellectual property and patents, streamlining the management, transfer, and monetization of these assets around the clock.

Lastly, the process of tokenizing real-world assets can cut costs by removing intermediaries such as lawyers and banks.

Considering these factors, the horizon for tokenized assets seems promising. Traditional finance firms are already displaying interest in tokenizing their tradeable assets. With mainstream adoption, market projections suggest significant growth potential, with the tokenized assets market projected to reach $16 trillion by 2030.

Obstacles: Regulatory challenges are significant, as comprehensive frameworks for investor protection and asset digitization are still under development globally. Overcoming these hurdles will require time, collaboration, and perseverance. However, the potential rewards are substantial.

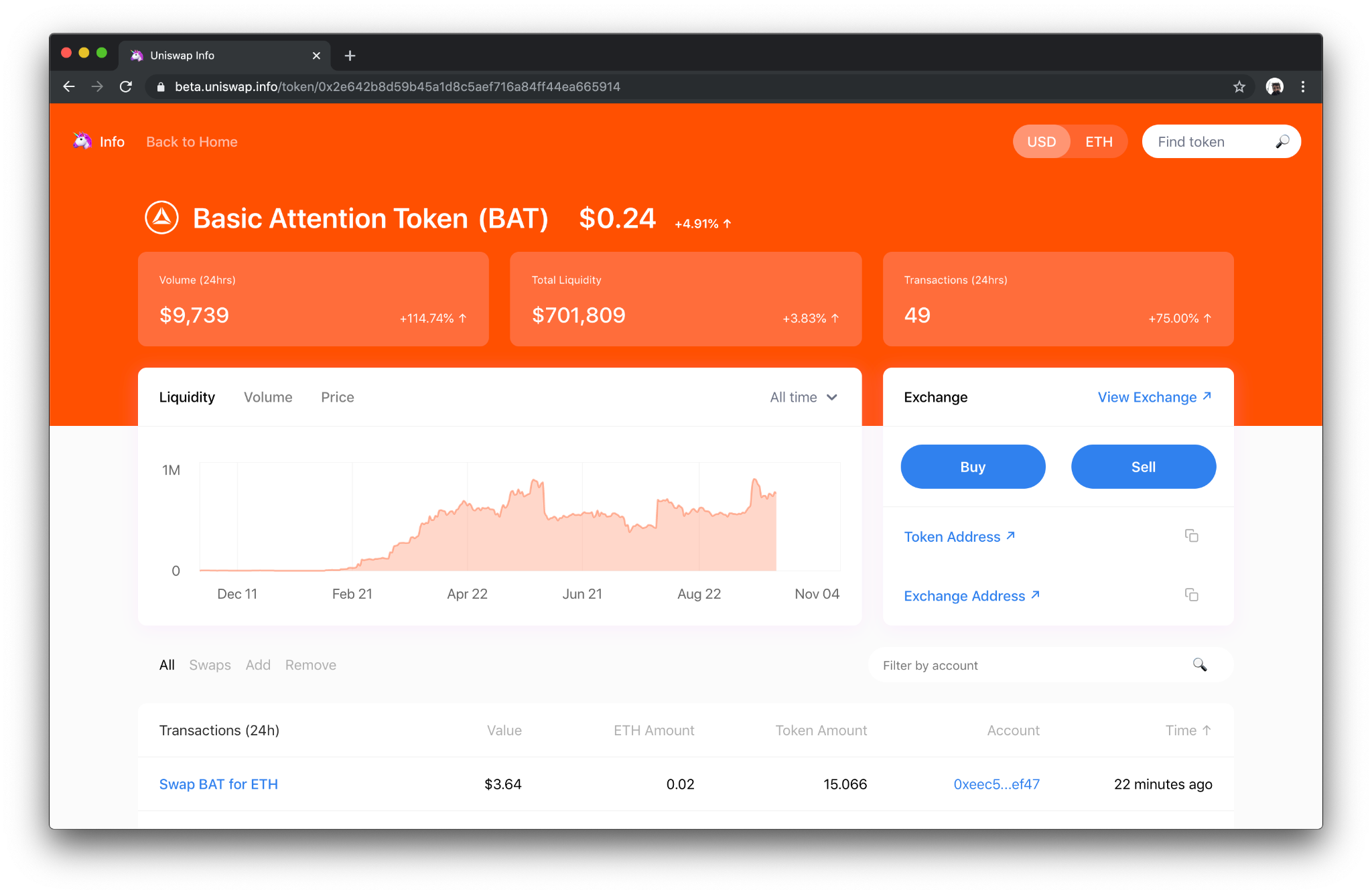

Decentralized crypto exchanges (DEXs) have emerged as formidable alternatives to centralized exchanges. Operating on blockchain platforms, DEXs facilitate direct peer-to-peer trading without intermediaries, offering enhanced security and global accessibility.

Potential: Decentralized exchanges (DEXs) come with several advantages over centralized exchanges (CEXs). They boast transparency, privacy, and often lower fees. However, two specific factors lead me to believe that DEXs are poised for substantial growth.

The first factor revolves around non-custodial trading. DEXs eliminate the need for a central entity to hold users’ funds, significantly mitigating the risks linked to hacks or potential fund misuse. User funds are held by them until the trade is executed through a smart contract, which enhances the overall security of the exchange. This attribute is gaining favor among traders, driven by concerns about how centralized exchanges handle and utilize user funds—especially following incidents like the FTX collapse.

The second factor driving DEX expansion is global accessibility. These exchanges don’t impose geographic limitations on users, enabling anyone with an internet connection and a compatible cryptocurrency wallet to partake in trading. This accessibility extends to individuals in regions with restricted access to traditional financial services or in countries with stringent cryptocurrency regulations. Consequently, the popularity of DEXs grew among Americans when the SEC categorized many altcoins as securities.

Obstacles: Liquidity remains a challenge compared to centralized exchanges, potentially limiting trading options. Moreover, the technical familiarity required for blockchain usage and complexities surrounding token transactions, including gas fees, might discourage novice traders.

Telegram trading bots are reshaping crypto trading as we know it. These bots seamlessly connect with users’ wallets and decentralized exchanges. Using simple chat commands, users can quickly trade and even set instructions for stopping losses or securing profits, even when they’re not online, adding an extra layer of security. These bots also have safeguards against potential scams from token developers, providing users with added protection.

But these bots offer more than just trading convenience. They provide advanced features like yield farming and copy trading, letting users copy the successful moves of experienced traders. These bots also support multi-wallet trading, which allows users more flexibility by bypassing wallet limits on certain tokens.

It’s not just about trading, though. These bots also supply real-time market data, including trading signals and technical analysis, to help users make informed decisions. Additionally, they help with direct peer-to-peer transactions and can even be used as payment processors by businesses, making them versatile tools in various scenarios.

Potential: Operating these bots is user-friendly, and their integration with Telegram’s extensive user base simplifies DeFi engagement for a wider audience. Growing adoption is evidenced by substantial revenues generated by leading projects.

Obstacles: Persistent security concerns necessitate caution, emphasizing the need for separate wallets designated for trading purposes to mitigate risks.

The cryptocurrency industry’s trajectory continues to be marked by innovation, introducing promising use cases that challenge conventional paradigms. While the aforementioned trends present exciting possibilities, acknowledging potential challenges is paramount. Staying informed, inquisitive, and vigilant is crucial as we navigate this evolving landscape. By combining innovative vision with prudent decision-making, the crypto industry’s potential for exploration and transformation remains significant.